Disclosure: Some of the links below are affiliate links, meaning, at no additional cost to you I will earn a commission if you click through and purchase.

When I went to India the first time, I would incur wallet-gouging ATM fees every time I withdrew money. I was losing over $12 every time I went to the ATM. It didn’t take a genius to know there had to be a better way.

Now as I’m traveling in India I pay zero in ATM fees and can show you how… even if you have terrible credit as I do.

How can foreigners avoid ATM fees when traveling in India? Choose a bank that has no ATM fees worldwide. For Americans, there are two options. If you have bad credit, Radius Bank is great. If you have good credit, Charles Schwab High-Yield Investor Checking Account is better.

I researched many bank accounts before I started traveling in India because I knew I would be going to the ATM over and over again, and I didn’t want to be losing money every time. Since I had bad credit, a lot of the best accounts wouldn’t accept me 🥶

However, I found a great one and here’s what I learned that can save you money and time…

The Fees that Could Cause You to Lose 100s of Dollars While Traveling

I was using my Bank of America account when I first traveled in India and I would get charged 3 fees on every ATM transaction. The three fees are:

- Your bank’s fee: Charges for using a non-network ATM $$$

- The ATM’s fee: Charges you for using the ATM $$$

- Foreign Transaction Fee: $$$

For Bank of America, I would pay:

- Bank of America’s Fee: $5 every time I used a non-network ATM

- The Local Indian ATM Fee: $3

- Bank of America’s Foreign Transaction Fee: 3%. So if I withdrew $150 that adds up to $4.50.

The total charge on every $150 I withdrew was $12.50.

I was losing 8% of my money every time. That’s good money! That would buy me:

- 86 masala chai teas on the street.

- 17 masala dosa dinners.

- 1 night in a decent hotel.

My first trip was only 3 weeks so I only lost about $50. But now that I’m living in India and I go to the ATM at least twice a month, I would easily have lost a couple of hundred dollars.

That’s why I did the research to find a way to avoid paying ATM fees and I found the holy grail for travelers with terrible credit like me…

Radius Bank: No ATM Fees Worldwide

Radius Bank is an online bank that does NOT charge you when you use a non-network ATM. They will also reimburse you for all the ATM fees that you’ve paid.

They have their own app, so I can monitor my account in India. I still use Bank of America but every month I set it up to automatically send money to my Radius account. I always have money I can withdrawal and I pay zero ATM Fees. 😎

There are some other benefits:

- No hard credit inquiry. So if your credit is terrible, you’re still eligible.

- Start an account with only $100.

- No monthly maintenance fees.

How are the interest rates?

- If you maintain a balance of $2,500 to $99,999 you are eligible for a 1.0% APY interest rate.

- If you maintain a balance of more than $100,000, then you are eligible for a 1.2% APY.

I do NOT keep that much, haha, and use a separate high-interest checking account for higher interest rates. I only use this to avoid ATM fees!

The drawback with using Radius:

- There is a 1% Foreign Transaction Fee. Therefore, every ATM withdrawal is NOT completely free, instead I pay $1.50 for a $150 withdrawal.

- Moving money between my accounts takes about 5 days. This is common when using online banks but could cause trouble if I needed to move money in an emergency.

Overall I’ve been very happy with using Radius and $1.50 for each ATM withdrawal is worth it.

If you’re interested, you can sign up here in 3 minutes.

Quick Note – Sending and Receiving Money from the USA in India:

One way I handle transferring money abroad is by using Wise, formerly Transferwise since they have low fees and it’s super easy to do with just my email address. I’ve had friends reimburse me and saved thousands with recurring payments from US clients versus other services like Paypal.

If you are looking to send money abroad, it’s a great tool — much cheaper than using your local bank. You can also get your own local bank account details in Europe, UK, US, Australia and New Zealand with the Wise Borderless account.

Also, Indians can now transfer money in rupees to 40+ countries.

To learn more, check out the details here.

Charles Schwab Bank High Yield Investor Checking Account: No ATM Fees or Foreign Transaction Fees

Charles Schwab’s checking account is the most highly recommended bank account to use for traveling to India or anywhere.

For each ATM transaction, you will NOT pay anything in ATM or foreign transaction fees. Here is a list of all the benefits:

- Unlimited ATM fee rebates worldwide

- No monthly maintenance fees

- No account minimums

- 0.40% APY on your account balance (subject to change)

- No foreign transaction fees

- Get a linked brokerage account

- No overdraft fees

This is a great account.

The only downside is:

They do a hard credit inquiry so if you have bad credit, then you would not be eligible for this account. 😤

If you’re interested in getting started, you can sign up here.

Capital One 360: No ATM Fees or Foreign Transaction Fees But…

Another option is Capital One’s 360 account. They do NOT charge an ATM fee and they do NOT charge a foreign transaction fee.

Unlike Radius though, you can be charged by the ATM operator and you will not be reimbursed. Therefore you may be paying $3 to $5 per ATM transaction, depending on what ATM you use.

There are some other benefits to this account:

- No monthly maintenance fees

- No minimum balances

- Can earn 2.0% APY if you keep a minimum of $10,000

I signed up for this bank account as well to test it and I had a hard time transferring my money into the account, so I closed this account. I would have kept it as a backup option had it been easier to use and it may work for you.

If you are interested, you can sign up here.

Wondering How Much You’re Paying in Fees?

Here are the ATM fees and foreign transaction fees at major banks:

| Bank | Non-Network ATM Fee | Non-Network International ATM Fee | Foreign Transaction Fee |

| Bank of America | $2.50 | $5.00 | 3% |

| BB&T | $3.00 | $5.00 | 3% |

| BBVA Compass | $2.50 | $2.50 & 1% | 3% |

| BMO Harris | $2.50 | $2.50 | 3% |

| Capital One | Free | N/A | 0% |

| Chase | $2.50 | $5.00 | 3% |

| Citibank | $2.50 | N/A | 3% |

| First Tennessee Bank | $3.00 | $3.00 | *** |

| Comerica Bank | #2.50 | $5.00 | 3% |

| Fifth Third Bank | $2.75 | $5.00 | 3% |

| HSBC | $2.50 | $2.50 | 3% |

| KeyBank | $2.50 | $5.00 | 3% |

| M&T Bank | $3.00 | Whichever is Larger: $5.00 or 3% | 3% |

| PNC Bank | $3.00 | $5.00 | 3% |

| Regions Bank | $2.50 | $5.00 | 3% |

| Santander | $3.00 | $6.00 | 2.75% |

| SunTrust | $3.00 | $5.00 | 3% |

| TD Bank | $3.00 | N/A | 3% |

| U.S. Bank | $2.50 | $2.50 | 3% |

| Union Bank | $2.00 | $5.00 | 3% |

| Wells Fargo | $2.50 | $5.00 | 3% |

| Huntington National Bank | $3.00 | 3% | 3% |

| Bank of the West | $2.50 | $2.50 | 2% |

| City National Bank | $2.50 | $2.50 | *** |

| People’s United Bank | $2.95 | $2.95 | 3% |

| Frost Bank | $2.00 | $2.00 | *** |

| Synovus Bank | $2.50 | 3% | 1.5% |

| First National Bank of Pennyslvania | $2.50 | $2.50 | *** |

| Associated Bank | $2.50 | $2.50 | *** |

| Iberia Bank | $2.00 | 3% | *** |

***I couldn’t find this information.

This information is accurate as of January 2018. The banks reserve the right to change this information at any time so check with your bank for the most up-to-date rates.

Other Options for Getting Money in India?

ATMs are the easiest way to get money while traveling in India. You can also get money in a few other ways though.

Transferring Money using Wise

Indians can now transfer money to 40+ countries just using an email address. I’ve used it to have a friend easily reimburse me for shared rent and we saved a lot of money versus using another service like Paypal since the fees are so low.

If you want to learn more, check out the details here.

Exchange money before you come

You could exchange some money at your local bank or your local AAA, so that you already have Indian rupees. AAA offers competitive rates, far better than what you might get exchanging money at the Indian airport on arrival. If you think ahead then you can have money to use when you arrive instead.

The downside of this method is that you have to carry a lot of money with you. The exchange rates are probably NOT as good as what you will get with one of the ATM cards that I have mentioned above either.

Exchange money in the airport

I usually exchange $50 when I get off the airport instead of exchanging money at a AAA. This is costly and I probably lose about 5-10 rupees for every dollar. Therefore I lose about 250 – 500 rupees when I exchange. This works out to $3 to $7. That’s a lot considering I’m only exchanging $50.

However, it is so easy and apparently I’m lazy, haha. But it’s nice to have some cash on me for the taxi ride. They usually stop for chai. 😎

Exchange money at a authorized local place

You can get much better rates by going to an authorized local exchange rate place.

If you are in are in a big city, there are RBI-approved money exchangers that can change your money.

Ask at your hotel front desk and they should know and be able to help you out.

Or if you are in a town like me you can find unauthorized vendors. My landlord exchanges money and he has a good rate. You’ll have to do this at your own risk though.

Can you still use traveler’s checks?

My mom’s coming to India and she asked me what was the best way to get money here, and should she use traveler’s checks? Traveler’s checks are not as popular as they used to be, because ATMs are the best way to get money as you travel.

Traveler’s checks are a good back-up form of currency though. In India, sometimes the ATMs run out of money so you could then exchange money using traveler’s checks.

If you are in a big city, go to an American Express or Thomas Cook office, as these international companies will be able to help you out.

Can you use an international credit card in India?

Look for a credit card that will NOT charge you a foreign transaction fee. I use a Discover card because there is NO foreign transaction fee and they will accept you even with bad credit.

If you have good credit there are a lot of options for credit cards with NO foreign transaction fees, and some will give you bonuses like frequent flyer miles.

Related Question About How To Get Money While Traveling In India:

What is the ATM withdrawal limit for foreigners in India?

10,000 rupees for each transaction or ~$150 USD. I’ve been able to pull out 30,000 rupees (~$450 USD) in one day before I am at my limit.

However, some ATMs will limit you to 10,000 rupees a day and 25,000 rupees a week.

It does vary from ATM to ATM and from bank to bank though, so I would NOT count on withdrawing much more than 10,000 rupees each day.

What is the best ATM in India?

One that has money. Haha, the ATMs can run out of money so I will often have 10,00 rupees as a back-up and will draw out my rent money in advance of the payment. I do NOT want to get stuck without money.

In my town, not every ATM works for me, so I would suggest you testing a few ATMs near your rental home or hotel. Then if you need money you have options.

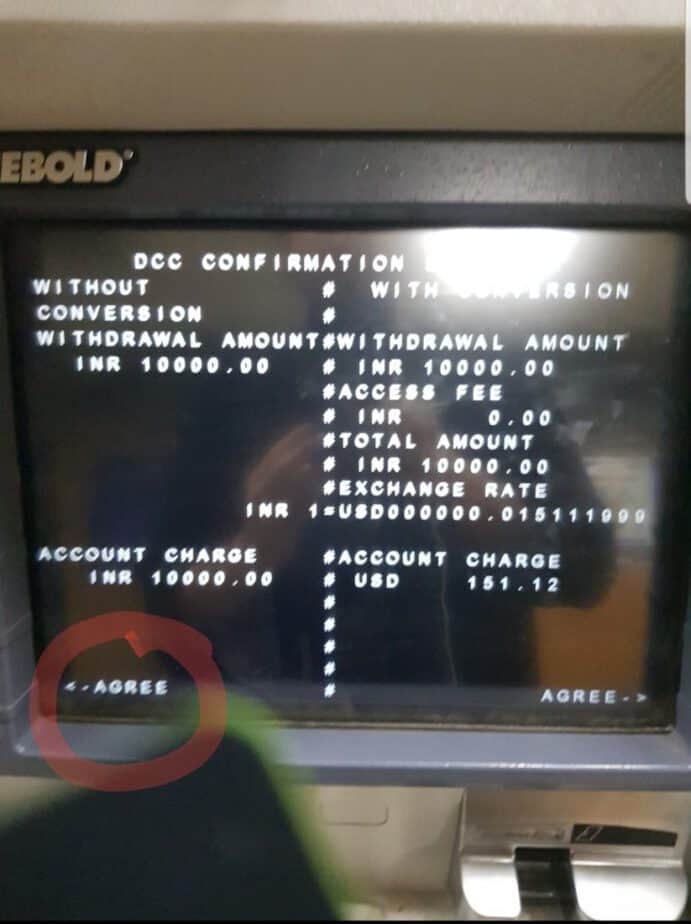

How to use an ATM in India?

It’s confusing to use an ATM in India. Here’s what I found to work on the ATMs I use…

- I always withdraw the maximum which is 10,000 rupees

- Withdraw money from your CURRENT ACCOUNT

- There will be a bunch of numbers, just click ACCEPT.

- There will be a bunch more numbers, just click ACCEPT.

Can I withdraw money from any ATM in India?

You should be able to, but it’s India so you may not always be able to. There is only one near me that works for me. There are two that do NOT work for me.

Does India have ATMs?

Yes. I’m in a town of just over 100,000 people and within a few miles there are 3 ATMs. In a big city, you will find many more options.