You can’t bring Indian rupees into India, so you’ll need to exchange your currency, use ATMs, or your credit or debit card. But some methods have way more fees than others…

How can you exchange money in India? ATMs will give you the best rate. Credit and debit cards without foreign transaction or currency conversion fees are great too. You can also shop around for good exchange rates at banks, hotels, restaurants, and currency exchange kiosks.

When I first came to India, I make big mistakes when it came to exchanging money… I exchanged my US dollars for rupees at the kiosk in the airport. I also withdrew money with my Bank of America ATM. This meant I was losing at least $10 to exchange $150, and over the course of my trip meant I spent more than $50 on fees.

After traveling in India for years and doing hours of research, I now pay only 1% to exchange money, and can show you how to get the best rates… some of you can get money for free!

Using ATMs in India

Using ATMs in India is the best way to exchange money, because the bank will charge you it’s wholesale exchange rate automatically, making it cheaper than other methods. ATMs are everywhere as well, even in smaller villages, I’ve found ATMs.

One word of warning: Some banks do inflate their ATM rates, so look for ATMs from the big banks for the best rates. These are 7 of the biggest banks in India:

- State Bank of India (SBI)

- ICICI Bank

- HDFC Bank

- Axis Bank

- Kotak Mahindra Bank

- IndusInd Bank

- Yes Bank

Below are some more tips for using ATMs in India so you can exchange your money and keep buying a steady supply of chai 🙂

Know ATM Locations in the Airport

When you arrive in India, you are going to want cash for a taxi, meal or chai but in some airports it can be difficult to get cash quickly.

The currency exchange booth will be very easy to find, but the exchange rate will be much higher than in big cities. Plus, you might be paying hidden commission fees.

To get good rates, research the ATM locations in the airport you are flying into, so you can get cash at a good rate from the ATMs.

Here are the ATM locations at the 7 most popular Indian airports:

- Indira Gandhi International Airport, New Delhi

- Chhatrapati Shivaji International Airport, Mumbai

- Chennai International Airport: Terminal 1 & 2 Arrivals

- Cochin International Airport: No ATMs in International Arrival Terminal. The ATMs are in the Domestic Arrival Terminal and on the south edge of the parking lot.

- Kempegowda International Airport, Bangalore: Opposite arrival gate #11 (curb side), The QUAD by BLR, Arrival hall near gate # 13, International baggage claim area near the customs office.

- Rajiv Gandhi International Airport, Hyderabad: Arrivals – Public Transport center, Arrivals – Airport Village, Arrivals – Car Park Area

- Goa International Airport, Goa: When you come out of the International Terminal, turn right and it’s on your right.

If you’re arriving at another airport, you can find the ATMs locations with a quick Google search.

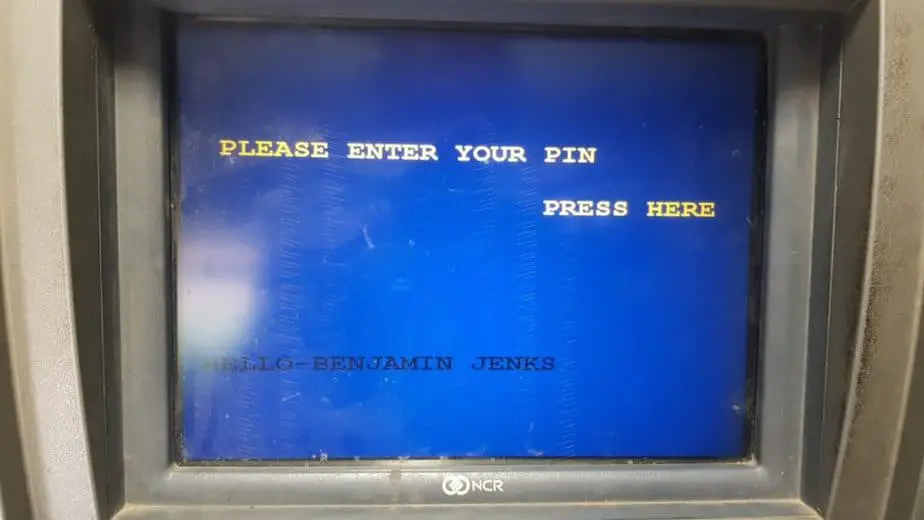

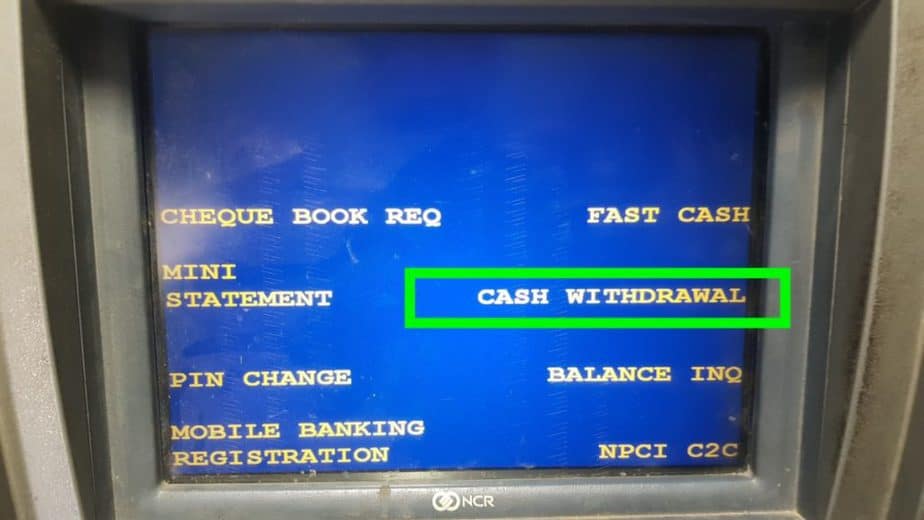

Know the Maximum Withdrawal Amount

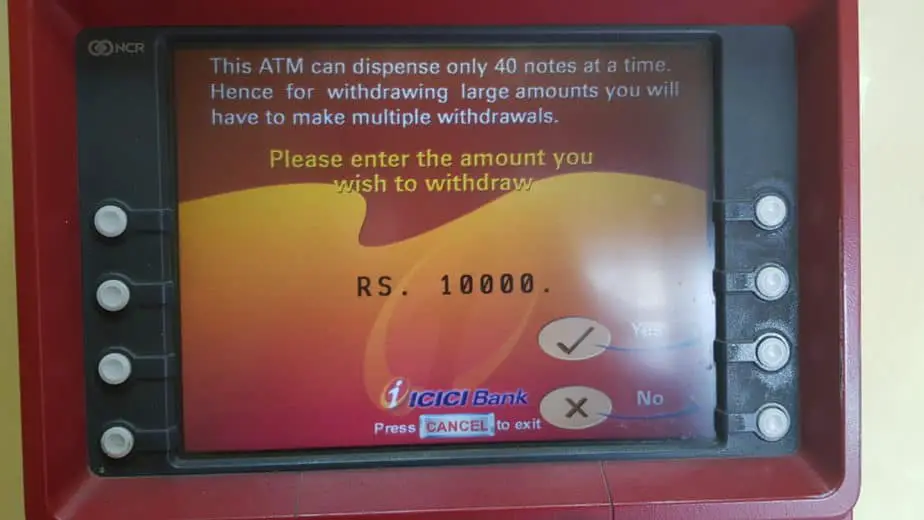

What’s the withdrawal limit at ATMs for foreigners? 10,000 Rs for each withdrawal. 40,000 Rs for the day.

Some ATMs will only let you withdraw 40 notes. Although it does vary based on the ATM you use, and your ATM card and bank.

But you want to take out as much as you can, because then you can limit your fees… below I will show you how to avoid the fees though.

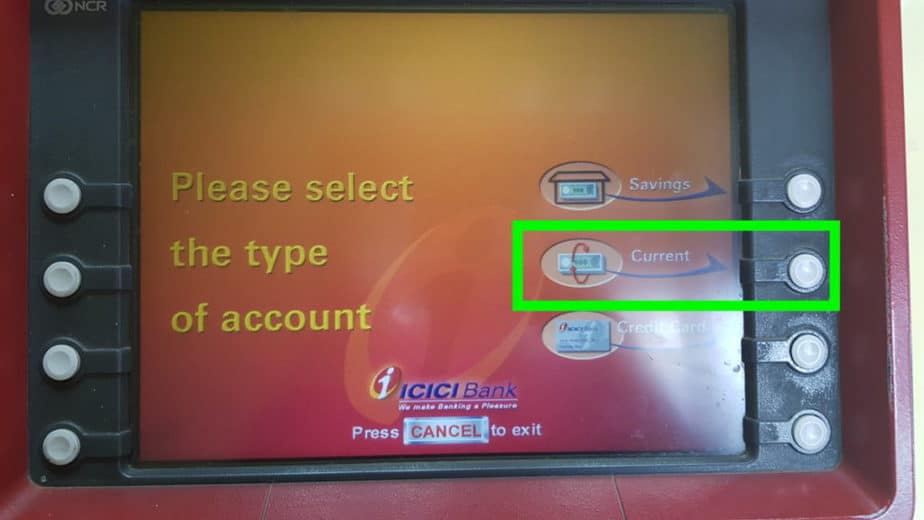

Choose ‘Without Conversion‘

Most ATMs will ask you would you like your money: With Conversion or Without Conversion?

Always choose Without Conversion.

It seems logical to choose with conversion, since you need to convert your money, right? What they’re really asking you is: Would you like us, as the ATM Bank to convert your money, or would you like your home bank to convert your money?

If the ATM Bank converts your money, you will pay an average of 10% more in fees.

Withdraw Money On Mondays

ATMs will often run out of money in India, especially on holidays and festivals. You have a better chance of finding full ATMs on Monday because they must refill them Monday morning or Sunday.

I’ve found more empty ATMs on the weekend, so I always go on Mondays to get money.

Have Two ATM Cards

Sometimes one of your cards just won’t work. Or both of them won’t work. Or all 4 of them won’t work, if you have a lot o fcards like I do.

It could be because your bank saw a withdrawal from India and locked you out. But more often than not it’s for a mysterious reason that you will never know.

I recommend having two ATM cards, so if one fails, you have a back-up you can try if one fails.

Two ATM cards should be enough for most travelers.

Expect To Get Locked Out By Your Bank

You should put in a travel notice with your bank before you travel, telling them you will be in India and for how long.

However, you should still expect to get locked out. I’ve had to call my bank a number of times even with travel notices.

Just plug your bank’s number into your contacts so you can quickly make a call and get your card unlocked.

Get an ATM Card With Zero (or Low) Fees

You might be paying 3 fees for each ATM withdrawal. Or you can pay zero fees. There are three fees most ATMs and banks will charge:

- The ATM’s fee: $0 to $5

- Your Bank’s fee: 0 to $5

- Foreign transaction fee: 1 to 3%.

For my Bank of America card, this was costing me $10 for every transaction. Now I pay $1.50 for each withdrawal.

I use a Radius Bank ATM card.

- They refund me for ATM fees from other banks.

- They do NOT charge me when I withdraw money.

- The foreign transaction fee is 1%.

So I pay $1.50 for withdrawing $150. I use Radius because I have terrible credit and they will accept anyone.

If you have good credit, the Schwab High Yield Investor Checking Account has zero fees for each ATM withdrawal and no foreign transaction fee.

Credit and Debit Cards

Credit and debit cards can be as good as ATMs for getting great rates. In some cases, cards can be better because you do NOT have to worry about an ATM charging you an inflated fee.

But you need to get the right card and make sure the merchant doesn’t charge you any fees.

Avoid Credit and Debit Card Fees

To get the best rates, you want to avoid two fees:

- Foreign Transaction Fees: Charged by your credit card and is usually 0 to 3%.

- Currency Conversion Fees: Charged by the merchant

Before you shop, ask the merchant if they charge credit card fees because you can add this into your negotiations. If you already negotiate for items and then find out they are charging extra credit card charges, it can be difficult to get them to waive that fee.

Use Major Credit Cards like Visa or Mastercard

Visa or Mastercard are the best cards to use. American Express and Discover have great deals and many do NOT charge foreign transaction fees, yet they are accepted in fewer places.

I use a Discover card and I haven’t been able to use it as often as I’ve liked.

Place A Travel Notice On Your Card

Same as your bank, you want to let your card know you will be in India and for how long. Although you should expect to get locked out of your card, if your experience is anything like mine 😉

Swipe Versus Chips

Many smaller shops and merchants might not have the technology to read a chip card, as they are used to swiping.

I always check ahead of time before shopping and spending any time to be sure I can pay.

Do NOT Rely Exclusively on Cards

Most smaller merchants still only use cash, so if you come to India expecting to only use your cards like you can in the US, then you will be disappointed.

But cards are a great way to pay for hotels, restaurants, and tours, so should be used as much as you can.

Exchanging Currency

Bring a couple of hundred dollars of your local currency for your travels. You’ll use this money to:

- Exchange $50 at the airport, if you can’t find an ATM

- Keep as a backup

I always hid a couple hundred US dollars on me, just in case. Then if I can’t find an ATM that works or I get lazy, I can exchange it at most hotels. I also like to have some US dollars just in case something where to happen.

Do NOT Exchange Money at the Airport

Try to find an ATM and avoid the airport currency exchange booth. You will pay a much higher exchange rate here and you are often paying hidden commissions.

I have exchanged $50 before so I had some cash when I couldn’t find the ATM, but now I research where the ATMs are ahead of time so I’m prepped.

Do Shop Around For the Best Exchange Rates

Most nice hotels will exchange money, or they will point you someplace that has a good rate.

If you’re in a tourist area, you will find many places that want to exchange your money, so start looking ahead of time for the best rate. You can just Google your currency to rupees for the current rate. Or use an app like XE Currency.

Traveler’s Checks

When I was 13 and traveling with my grandmother in Europe, we got some American Express traveler’s checks since they are lower risk than cash. That used to be the way travelers could protect their cash, because you can get a refund if they are stolen.

However, with the increased use of ATMs, credit and debit cards, traveler’s checks are not popular and you will have a hard time cashing them.

You would need to go to a bank that has a foreign exchange and many branches of Indian banks do NOT do this.

If you decide to bring some, I’d only use them as a backup.

Black Market Currency Exchange

If you’re traveling in tourist areas you may hear rickshaw drivers or random people you meet on the street ask if you want to exchange money?

If you need money at that time, then this might seem like an easy solution, however, I’d recommend against it.

First, you may get fake bills. The Reserve Bank of India found that while the number of counterfeit notes was decreasing, there is still a significant number of them.

Second, you may not get a good rate.

Third, you may be supporting illegal activities. Terrorist and other shady groups rely on black market currency exchange to get the money they need.

Since most hotels will exchange your money, you can avoid this type of exchange to reduce your risk of anything illegal happening.

Summary:

If you’re traveling in India, then use ATMs to exchange most of your money and bring two cards. Also, bring a credit card with zero foreign transaction fees. Finally, bring a couple of hundred dollars to exchange and look for good rates at hotels.

If you’re planning your India travel budget I made a free tool you can use to estimate your travel expenses and you can also see all my expenses from a recent trip through India.